We're not just accountants, but Xero fans with a passion for smart bookkeeping. Since day one, we have used bookkeeping with Xero and a collection of powerful applications to ease admin tasks, freeing up more time to connect with our clients. Speak to our Xero experts today to learn how Xero can accelerate your business's bookkeeping and financial management!

Book A FREE ConsultationComputerized reminders and e-payments for swift cash flow.

Precise income and expense tracking with full reconciliation.

Real-time financial insights anytime, anywhere.

Easier sales tax, payroll, and admin tasks.

We make sure your financial records are in safe hands, so you can focus on expanding your business.

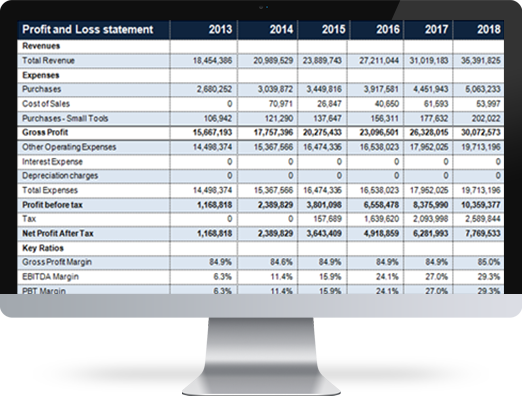

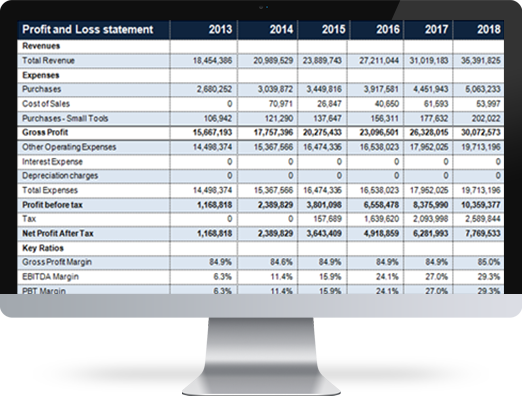

Measure: We scrutinize your company and inspect the numbers that matter.

Monitor: We check KPIs such as working capital, margins, burn rates customer acquisition prices, and cash.

Grow: We back you in thriving a sustainable business that works for you rather than you working for it.

Our five powerful approaches to make this happen:

We help expand your business quickly, but sustainably.

We enhance profitability by simplifying financials and revealing margin-boosting tactics.

Continue optimistic cash flow with better administration of receivables and payables.

Focus on what is precious to your business and concentrate on metrics that boost higher business valuation.

We aid your company prosper for 10+ years by stressing key metrics and their influence.

For property owners, builders, and agents, let us rationalize your finances while you emphasize giving great homes.

Automate your procedures and scale your online business effortlessly, 24/7, on platforms such as Amazon, eBay, and Shopify.

Let us take care of inventory, payables, receivables, and cash flow so you can concentrate on running your retail business effortlessly.

We know your time is valued. Let us handle the numbers while you pay attention to expanding your freelance or consulting company.

Pay attention to your creative work, while we provide bookkeeping solutions and help you stay up-to-date with business finances.

Enjoy trained Xero bookkeeping solutions for your hospitality business, with rational pricing that accelerates your business.

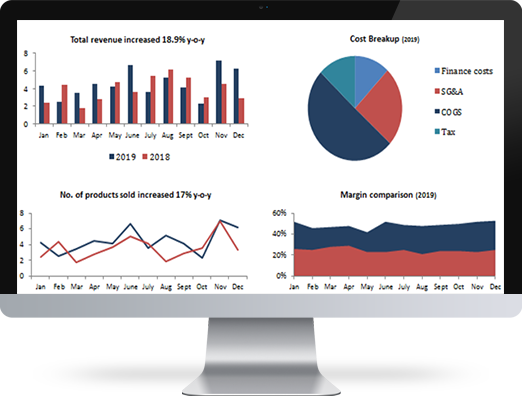

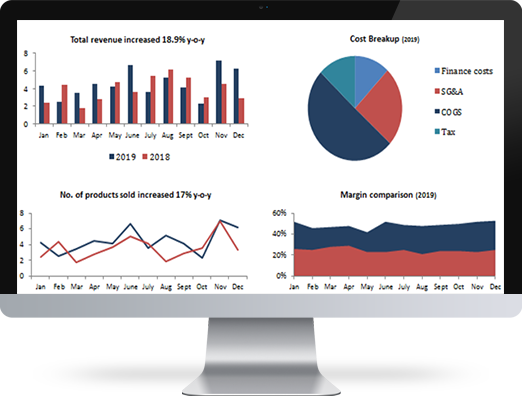

Your numbers have a voice – we’ll help you hear it loud and clear with easy-to-read graphs.

Let’s make your numbers work for you!

Real-world testimonials showcasing the value we bring to every partnership

I have worked with Vinod for two years now, and he and his team have done a great job taking care of my 30+ clients. I can highly recommend him.

Judd HumpherysQBO Bookkeeper

United States

We run a complex multi-channel e-commerce business in several countries, so working with the Clarigro team has allowed me to remove the accounting complexity and focus on building my core business.

NxTStop ApparelUnited States

Vinod and his team have been incredible! They have helped us streamline our bookkeeping system, and ensure our books are accurate and up-to-date, and provide us with the analytics necessary to grow our company!

Genius GamesUnited States

Clarigro have become an invaluable extension of our design and branding business, Not Another™. We’ve worked with Clarigro for many years and thoroughly it. The service is quick, efficient, thorough, and fairly priced. I can’t recommend it enough.

Not Another CompanyNew Zealand

Working with Vinod and his team has made the process of daily accounting and monthly reporting easier for me allowing me the time to work on the business, no in it.

5 Star MarinesThailand

Feeling like your finances are a tangled mess? You're not alone. Many small business owners find themselves drowning in a sea of receipts, invoices, and unpaid bills. This constant financial...

Read MoreManaging payroll and staying compliant with tax regulations can be daunting for any business. That’s where ADP simplifies payroll compliance and tax filing with its innovative tools and services. By...

Read MoreThe e-commerce industry is booming, and with that growth comes a unique set of challenges for business owners. As your ecommerce business expands, so does the complexity of managing its...

Read MoreIn the competitive real estate industry, managing finances efficiently is critical to success. Whether you are a seasoned realtor or a property manager, real estate accounting software is a game-changer...

Read MoreManaging your business's finances is essential to ensure sustainable growth, but bookkeeping tasks often fall behind due to day-to-day priorities. This can lead to disorganized financial records, inaccurate data, and...

Read MoreIn today’s interconnected world, digital marketing has become a game-changer for businesses, particularly for local businesses in India. With increasing internet penetration and the widespread use of smartphones, digital platforms—especially...

Read MoreIf you’re a business owner or freelancer, understanding the 1099 form for contractors is crucial for accurate tax reporting. This essential tax document is used to report payments made to...

Read MoreIn today’s digital-first world, real estate businesses must adapt to online platforms to connect with potential buyers. Digital marketing services for real estate offer various tools and strategies to help...

Read MoreIn today’s competitive business landscape, securing investment or conveying your business idea effectively hinges on a well-designed pitch deck. A pitch deck design is more than just slides; it’s a...

Read MoreHow Digital Marketing Can Help Small Businesses Grow In today’s digital age, small businesses face numerous challenges in reaching new customers and staying competitive in their industries. Digital marketing has emerged...

Read MoreFeeling like your finances are a tangled mess? You’re not alone. Many small business owners find themselves drowning in a sea of receipts, invoices, and unpaid bills. This constant financial juggling act can significantly impact your focus, leaving you less time to innovate, grow your customer base, and ultimately, achieve your business goals.

However, you don’t have to navigate this financial maze alone. This guide will empower you with the knowledge and strategies to conquer your financial chaos and achieve true financial freedom.

Before we delve into the world of outsourcing, let’s address the foundational step: a thorough bookkeeping clean up. Imagine building a skyscraper on unstable ground – it’s destined for collapse. Similarly, effective financial management requires a solid foundation.

Think of it as a financial spring cleaning. It involves a meticulous review of all past financial transactions, reconciling bank accounts, categorizing expenses, and ensuring all records are accurate and up-to-date. This might seem daunting, but it’s an essential step towards achieving financial clarity.

A clean set of books is the bedrock of sound financial decision-making. It empowers you to:

If the prospect of a bookkeeping clean up feels overwhelming, consider seeking professional assistance.

Once your books are in order, it’s time to explore the transformative power of outsourcing accounting services for small business.

Managing and processing supplier invoices, ensuring accurate payments, preventing fraud, and optimizing cash flow by scheduling vendor payments.

Generating invoices, tracking payments, managing credit risk, following up on overdue accounts, and minimizing bad debts to ensure steady cash flow.

Verifying payroll records against financial statements, ensuring tax compliance, tracking employee deductions, and preventing errors in wage processing.

Matching sales transactions with financial records, ensuring accurate tax reporting, managing refunds/chargebacks, and identifying discrepancies to prevent fraud.

Monitoring stock levels, reconciling inventory with financial records, analyzing costs, preventing shrinkage, and ensuring compliance with valuation standards.

These services help businesses maintain financial accuracy, optimize cash flow, and improve compliance. Clarigro specializes in Outsourcing Accounting Services for Small Businesses, offering expert financial management, automated reconciliation, and industry-specific insights. Our team streamlines bookkeeping, reconciliations, and reporting, ensuring accuracy and efficiency. By leveraging automation and expert guidance, small businesses can save time, reduce costs, and focus on scaling their operations.

By embracing outsourcing accounting services for small business, you can transform your financial management, streamline your operations, and unlock your business’s full potential.

Remember, the key to success lies in finding the right partners, establishing clear expectations, and maintaining open communication throughout the process. By taking these steps, you can conquer your financial challenges, achieve sustainable business growth, and ultimately, achieve your entrepreneurial dreams.

Managing payroll and staying compliant with tax regulations can be daunting for any business. That’s where ADP simplifies payroll compliance and tax filing with its innovative tools and services. By combining tax preparation outsourcing with a payroll management system, ADP provides complete payroll solutions that cater to businesses of all sizes, including payroll services for small businesses.

Whether you are a small business owner or part of a large organization, managing payroll and taxes requires meticulous attention to detail. Outsourcing these processes with trusted providers like ADP allows businesses to save time, minimize risks, and focus on growth.

Payroll compliance involves adhering to a complex web of labor laws, tax codes, and regulations. Even small errors in payroll calculations or tax filings can lead to penalties, audits, or strained employee relationships. For businesses already juggling multiple responsibilities, managing payroll in-house can be overwhelming.

Outsourcing payroll to providers like ADP ensures accurate handling of compliance issues and reduces the administrative burden. Their payroll management system and tools are designed to process payroll with precision and efficiency.

ADP offers complete payroll solutions that ensure accurate and timely payment processing, tax calculations, and compliance reporting. Businesses can benefit from:

Tax filing is one of the most time-consuming tasks for businesses. ADP excels in tax preparation outsourcing, making it easier to file taxes accurately and on time. With a robust system in place, ADP handles:

For startups and smaller companies, ADP provides tailored payroll services for small businesses. These services are cost-effective and scalable, helping small businesses

access enterprise-grade payroll solutions without the heavy investment.

ADP integrates payroll processing with bookkeeping and tax preparation, streamlining the accounting process. This holistic approach helps businesses track financial data efficiently, improving overall financial management.

Outsourcing tax preparation to ADP or similar providers ensures businesses avoid costly mistakes. With outsourced tax preparation services, companies can:

For businesses using ADP, tax preparation services work seamlessly with payroll compliance tools, providing a one-stop solution.

Choosing the right payroll solution is crucial for any business. ADP, a leader in payroll and HR services, competes with alternatives like Gusto and Paychex. While all three platforms cater to payroll needs, ADP stands out for its versatility, scalability, and advanced features.

1. Features

2. Scalability

3. Customer Support

4. Pricing

ADP leads with its:

While Gusto is great for startups and Paychex serves mid-sized firms, ADP’s advanced tools and reliability make it the best choice for businesses seeking a scalable and efficient payroll solution.

Streamline your payroll with ADP for accuracy, compliance, and peace of mind.

Simplifying payroll compliance and tax filing is no longer a luxury but a necessity for businesses aiming to thrive in a competitive market. With ADP’s complete payroll solutions, companies can streamline operations, stay compliant, and save time. Leveraging tax preparation outsourcing ensures accurate filings and peace of mind. Whether you’re running a small business or a large enterprise, solutions like ADP are a game-changer for modern financial management.

Ready to optimize your payroll and tax compliance? Visit Clarigro’s Payroll Services for more insights!

The e-commerce industry is booming, and with that growth comes a unique set of challenges for business owners. As your ecommerce business expands, so does the complexity of managing its finances. Ecommerce bookkeeping is essential to keeping your business organized, profitable, and compliant. However, with multiple transactions, payment methods, inventory updates, and tax regulations to navigate, it’s easy for bookkeeping to become overwhelming. In this blog, we’ll explore the top 5 challenges in e-commerce bookkeeping and how to overcome them with effective bookkeeping solutions.

Accurate inventory tracking is a cornerstone of any successful ecommerce business. The challenge arises when it comes to managing large volumes of stock across multiple locations or sales channels (Shopify, WooCommerce, Amazon etc). Additionally, calculating the cost of goods sold (COGS) accurately is crucial for maintaining profitability. Without proper tracking and integration, inventory management can lead to errors, overstocking, or understocking, all of which can affect your business’s bottom line.

How to Overcome It:

To simplify inventory management, integrate your e-commerce platform with ecommerce bookkeeping software that can handle inventory tracking and automatically calculate COGS. Many modern bookkeeping solutions offer real-time inventory tracking, helping businesses monitor stock levels and sales in one place. This also ensures that all transactions, including purchases, sales, and returns, are accurately reflected in your financial records, making your bookkeeping for ecommerce easier and more efficient.

By automating these processes, you can focus on growing your business while ensuring that your books are always in order.

One of the biggest hurdles in ecommerce bookkeeping is ensuring that your business complies with sales tax regulations across different states, countries, and regions. With varying sales tax rates, rules, and reporting requirements, staying up-to-date can be overwhelming for ecommerce business owners, especially if they sell in multiple locations.

How to Overcome It:

To manage sales tax effortlessly, use ecommerce bookkeeping services that include automated tax compliance features. These tools help you calculate the appropriate sales tax based on the customer’s location, ensuring accurate reporting and minimizing the risk of errors. Many bookkeeping solutions are integrated with popular e-commerce platforms like Shopify and WooCommerce, and can automatically generate tax reports for each jurisdiction, making it easier to file taxes on time and stay compliant with regulations.

Additionally, outsourcing bookkeeping for ecommerce to experts who understand tax regulations can give you peace of mind, knowing that your business is operating within the law and avoiding costly penalties.

Most e-commerce businesses use multiple payment gateways such as PayPal, Stripe, Affirm, Amazon, Gift card, TikTok or credit card processors to manage high transaction volume. While these gateways offer convenience for customers, they also make bookkeeping more complex. With funds spread across different platforms, it’s easy to miss transactions or make mistakes when reconciling payments.

How to Overcome It:

The solution to managing multiple payment methods is using ecommerce bookkeeping software that integrates with all the major payment gateways. These tools automatically sync transactions from various payment processors into your bookkeeping solutions, ensuring that all sales, refunds, and fees are accurately recorded. Whether it’s payments via PayPal or credit cards, everything is reconciled and visible in one central system.

With these tools, your bookkeeping for ecommerce becomes seamless, and you’ll have a clearer, more comprehensive view of your business’s financial health.

Cash flow is the lifeblood of any business, and for ecommerce businesses, it’s particularly important. With fluctuating sales and seasonal demand, it can be challenging to predict how much money is coming in and going out of your business. Without effective management, you might run into cash flow problems, which could lead to difficulty covering operational costs, paying employees, or fulfilling orders.

How to Overcome It:

Effective bookkeeping solutions for e-commerce businesses include cash flow tracking and forecasting tools. These tools help you monitor both incoming and outgoing payments, giving you a clearer picture of your financial situation. You can set up regular cash flow forecasts to predict future income and expenses, helping you plan for slow months or high-demand periods.

Outsourcing your ecommerce bookkeeping to experts ensures that you receive accurate, up-to-date cash flow reports. With real-time tracking of expenses, revenue, and liabilities, you’ll be better equipped to make strategic financial decisions that support your business’s growth.

Returns and refunds are an inevitable part of running an e-commerce store, but they can create chaos in your bookkeeping if not handled properly. Each return or refund transaction must be accurately recorded and reflected in your financial reports to ensure that your books are balanced. Failure to manage returns correctly can lead to discrepancies in your revenue, profit margins, and tax filings.

How to Overcome It:

Many ecommerce bookkeeping solutions offer automated returns tracking those syncs with your inventory and financial records. Whenever a return or refund is processed, the system automatically updates your accounts and adjusts your sales figures. This integration makes it easier to track and manage returns, ensuring that your bookkeeping for ecommerce is always accurate and up-to-date.

For businesses with high return rates, having an efficient system in place will save time and reduce the risk of errors, so you can focus on enhancing customer satisfaction and growing your business.

While the challenges mentioned above are common, other hurdles can complicate ecommerce bookkeeping:

At Clarigro, we provide additional support with automated accounting, helping ecommerce businesses save time and money while reducing manual processes. Our services are designed to streamline your bookkeeping, ensuring accuracy and efficiency across all financial operations.

By addressing these challenges with the right tools and expertise, your ecommerce business can thrive without the stress of managing complex financial tasks.

Running an ecommerce business presents several unique challenges when it comes to bookkeeping, but with the right tools and strategies, these challenges can be effectively managed. Whether it’s automating inventory tracking, ensuring tax compliance, handling payment gateways, managing cash flow, or tracking returns, ecommerce bookkeeping software can streamline your operations and save you valuable time.

At Clarigro, we specialize in providing expert ecommerce bookkeeping services that are tailored to the specific needs of your business. Our comprehensive bookkeeping solutions help you stay on top of your finances while ensuring that your records are accurate, compliant, and optimized for growth. Contact us today to learn how we can help you overcome the challenges of ecommerce bookkeeping and take your business to the next level.

In the competitive real estate industry, managing finances efficiently is critical to success. Whether you are a seasoned realtor or a property manager, real estate accounting software is a game-changer for organizing transactions, tracking income and ensuring tax compliance.

But what is bookkeeping in real estate? It’s the meticulous process of recording financial transactions, tracking analysis, managing budgets, and maintaining accurate records, which are essential for informed decision-making related to properties. Real estate bookkeeping is different from simple bookkeeping which include lease accounting, CAM calculation, Depreciation calculations, property valuation, property tax compliance. With the right real estate bookkeeping software, agents and businesses can achieve seamless financial management.

Let’s explore some of the top solutions tailored for real estate professionals and small businesses.

Real estate transactions can be complex, involving commissions, property expenses, taxes, and client payments. Specialized accounting tools streamline these tasks and provide:

For customized bookkeeping solutions, consider Clarigro’s real estate bookkeeping services, which combine professional expertise with advanced software capabilities.

For tailored bookkeeping support, you can also explore real estate bookkeeping services from Clarigro, which combine expertise with software efficiency.

When choosing the right bookkeeping solutions, prioritize these key features:

For more bookkeeping tips and services, visit our comprehensive bookkeeping solutions page.

1.QuickBooks Online

Why It Stands Out:

Perfect For:

Agents seeking bookkeeper accounting software that integrates well with third-party tools.

Limitations:

Customization for real estate-specific needs might require additional setup.

2. Buildium

Why It Stands Out:

Perfect For:

Property managers needing real estate accounting software with advanced reporting.

Limitations:

May not suit smaller businesses focused solely on transactions.

3. Xero

Why It Stands Out:

Perfect For:

Small businesses needing good bookkeeping software for small business operations.

Limitations:

Lacks some real estate-specific integrations.

4. Propertyware

Why It Stands Out:

Perfect For:

Propertyware helps real estate businesses managing a portfolio of rental properties.

Limitations:

More suitable for larger enterprises.

5. Wave

Why It Stands Out:

Perfect For:

Those seeking entry-level bookkeeping software for real estate agents.

Limitations:

Limited advanced features for growing businesses.

For expert guidance in selecting the best solution, check out our accounting services page.

Perfect For: Property managers seeking an all-in-one solution for managing multiple properties.

Limitations: May not suit small-scale businesses due to higher pricing tiers.

Perfect For: Real estate firms handling commercial and residential properties.

Limitations: A steeper learning curve for first-time users.

Perfect For: Enterprise-level property managers needing customizable solutions.

Limitations: Higher cost compared to other software options.

Perfect For: Real estate investors and managers seeking efficient portfolio management.

Limitations: Best suited for mid to large-scale operations.

Perfect For: Small-scale agents looking for affordable accounting solutions.

Limitations: Requires additional customization for real estate-specific needs.

No more manual ledger entries—automated tools reduce repetitive tasks.

Monitor your financial health and make data-driven decisions.

Generate accurate reports for tax filings and audits.

From a solo agent to a growing firm, software grows with your needs.

For those who prefer outsourcing, explore Clarigro’s real estate bookkeeping services for hands-free solutions.

1.Assess Your Business Requirements

Do you need a tool for simple bookkeeping or advanced property management?

2. Set a Budget

Free tools like Wave might suffice for startups, while established businesses might need premium options like Buildium.

3. Check Integration Capabilities

Ensure the software integrates with your existing tools like CRM systems or tax software.

4. Consider Scalability

Choose software that supports your growth trajectory.

When it comes to financial management in real estate, Clarigro offers more than just services—we deliver solutions. With expertise in real estate accounting software and industry-specific challenges, we provide tailored support for agents, property managers and businesses.

Key offerings include:

Visit our accounting services page to explore how we can support your financial needs. Outsourcing services, like those offered by Clarigro, combine expert management with advanced software for optimal results.

Investing in the right real estate accounting software can transform how you manage finances, improve compliance, and save time. From automating tasks to offering real-time insights, these tools are indispensable for agents and property managers alike.

Ready to optimize your bookkeeping? Explore our accounting services and see how Clarigro can help you achieve financial clarity and growth.

Managing your business’s finances is essential to ensure sustainable growth, but bookkeeping tasks often fall behind due to day-to-day priorities. This can lead to disorganized financial records, inaccurate data, and potential compliance issues. To prevent these challenges from affecting your business, investing in bookkeeping clean up services can be transformative. At Clarigro, we specialize in cleanup and catchup bookkeeping, offering solutions tailored to your unique needs.

Whether you are a small business owner or manage a large enterprise, catching up on overdue financial records requires a structured approach. To learn how to keep your books accurate and compliant, explore our bookkeeping clean up services.

How to start cleanup for messy books

1.Achieving Financial Accuracy

Messy financial records lead to discrepancies that can distort your understanding of profits, expenses, and cash flow. Accurate financial data is critical for building trust with stakeholders and creating a strong financial strategy. Cleanup services help ensure every transaction is correctly categorized, so your records reflect the true state of your business. Clean financial records ensure accurate decision-making and help avoid potential compliance issues. Learn more about maintaining accurate business records on the IRS’s Recordkeeping for Businesses page.

2. Easing Tax Compliance

Unorganized financial records can result in missed deductions, underreported income, and compliance penalties. A thorough cleanup ensures your books are tax-ready, reducing the likelihood of audits. With services like virtual bookkeeping or remote bookkeeping, you can have experts keep your tax filings error-free.

3. Improving Business Decision-Making

Clean and up-to-date financial records provide a reliable foundation for analyzing your business’s financial health. This insight empowers you to make informed decisions, whether it is about scaling operations, cutting costs, or planning for growth.

Businesses in major regions, including District of Columbia, Texas, Los Angeles, and others, can access our local services for personalized support.

Businesses often delay bookkeeping, leading to months—or even years—of unrecorded transactions. Sorting through these records can be time-consuming and overwhelming without professional help. Using tools like QuickBooks, alongside offshore accounting services, can ease the process by automating data entry and categorization.

2. Identifying and Correcting Errors

Mistakes such as duplicate entries, missed invoices, or incorrect categorizations are common in neglected bookkeeping. Finding these errors requires meticulous reconciliation of bank statements, financial reports, and receipts, which is best handled by experts in catch up bookkeeping.

3. Complex Reconciliation

Bank and credit card reconciliation involves matching financial records with actual transactions. The process becomes more complex when records span multiple accounts, payment methods, or locations. Experts in bookkeeping services for small businesses can ensure reconciliation is done accurately.

4. Staying Compliant

Every business must comply with tax laws and reporting regulations. Outdated or incomplete financial records can lead to hefty penalties. Our team at Clarigro specializes in bringing records into compliance quickly and efficiently.

Software like QuickBooks, Xero, Wave or Sage can streamline the cleanup process by automating repetitive tasks. These tools reduce errors, improve accuracy, and offer detailed reports. Pairing these tools with outsourcing accounting services for small businesses provides an added layer of expertise.

2. Organize and Categorize Transactions

Categorizing expenses and income correctly is essential for accurate reporting. Grouping similar transactions under predefined categories helps identify patterns in spending and ensures compliance with accounting standards.

3. Focus on Reconciliation

Reconciliation is critical for ensuring your financial records match your actual transactions. Regular reconciliation helps identify missing or duplicate entries early on, simplifying the cleanup process.

4. Start with Older Transactions

Starting from older transactions allows you to address historical discrepancies first. This approach ensures that your current records are built on an accurate foundation, reducing errors in your ongoing bookkeeping.

5. Engage Professionals

Partnering with professionals for bookkeeping clean up services ensures that the process is handled efficiently and with minimal disruption. At Clarigro, our bookkeeping services are designed to handle complex catchup and cleanup tasks for businesses across industries.

Skipping reconciliation can result in discrepancies that compound over time, making future cleanups more difficult. Regular reconciliations are key to maintaining accurate records.

2. Relying on Manual Processes

Manually updating books is prone to human error. Automation and virtual bookkeeping services can save time and improve accuracy by eliminating manual entry mistakes.

3. Missing Documentation

Without proper documentation, it becomes challenging to verify transactions. Always retain receipts, invoices, and contracts, and digitize them for easy access.

4. Delaying the Process

Procrastination only adds to the problem. Tackling bookkeeping cleanup sooner rather than later ensures smoother operations and prevents further complications.

5. Overlooking Professional Help

Attempting to handle cleanup in-house can lead to inefficiencies. Hiring professionals—such as Clarigro’s remote bookkeepers or accountants for small businesses—saves time and ensures compliance.

Outsourcing bookkeeping tasks comes with numerous benefits:

Hiring in-house accountants can be costly, especially for small businesses. Outsourcing to experts like Clarigro offers high-quality service at a fraction of the cost.

Outsourcing gives you access to seasoned professionals who understand tax laws, accounting standards, and industry-specific practices.

By delegating bookkeeping tasks, you can focus on growing your business while professionals handle your finances.

Outsourcing services are flexible, allowing you to scale up or down based on your needs. Whether you require ongoing support or a one-time cleanup, Clarigro provides customized solutions.

Our CPA Accounting Outsourcing page offers more details about our scalable services for businesses of all sizes.

At Clarigro, we simplify Bookkeeping Clean Up Services by implementing diagnostic report and checklist for catchup bookkeeping process with tailored solutions. Here’s how we can assist:

Visit our accounting services page to explore the full range of solutions we offer for bookkeeping and beyond.

Cleanup and catchup bookkeeping are critical for maintaining financial health, ensuring compliance, and making informed business decisions. With professional support from Clarigro, your financial records can be transformed into a reliable asset for your business.

Start your journey to better financial management with our bookkeeping clean up services. Visit Clarigro’s bookkeeping services page today to learn how we can help you streamline your business operations.

In today’s interconnected world, digital marketing has become a game-changer for businesses, particularly for local businesses in India. With increasing internet penetration and the widespread use of smartphones, digital platforms—especially social media marketing services—have opened new avenues for small and medium-sized enterprises (SMEs) to thrive and compete effectively. Let’s explore how digital marketing helps local businesses in India, the relevant channels they can use, and budget considerations for working with an agency.

Digital marketing helps businesses create a robust online presence, making it easier for customers to discover their products or services. Google My Business (GMB) is one of the most critical tools for local businesses. By setting up and optimizing a GMB profile, businesses can appear in local search results, Google Maps, and even voice searches. Social media platforms also play a vital role in increasing online visibility by reaching a broader audience and creating brand awareness. Leveraging social media marketing services enables businesses to create engaging content, manage campaigns, and build a loyal customer base.

Channels to Use:

Through search engine optimization (SEO) and paid ads, businesses can target specific audiences based on demographics, location, and interests. Platforms like Google Ads and Facebook Ads allow for precise targeting, ensuring your budget is spent effectively. Facebook marketing services allow businesses to tap into the platform’s vast audience through targeted ads, interactive posts, and community-building strategies. A reliable social media marketing agency in India can help local businesses craft campaigns that resonate with regional audiences while maximizing ad spends. Businesses can use social media marketing services to create tailored campaigns that resonate with local audiences while addressing their specific needs.

Channels to Use:

Social media platforms like Instagram, Facebook, and LinkedIn provide cost-effective ways to share your story, showcase products, and engage with customers. Regular posting and creative content can help establish your brand. social media marketing services india provide businesses with targeted strategies to reach and engage their audience effectively on platforms like Facebook, Instagram, and LinkedIn. Instagram marketing services help businesses leverage the platform’s visual appeal to showcase products, engage with followers, and build a strong brand identity. Social media marketing services are essential for creating a strong online presence, managing brand reputation, and engaging directly with customers. Innovative social media marketing services leverage trends like Instagram Reels, Facebook Stories, and live streaming to keep brands relevant and engaging.

Channels to Use:

Traditional advertising (TV, radio, or print) can be expensive and difficult to measure. Digital advertising, such as Pay-Per-Click (PPC) campaigns and social media ads, offers scalable and trackable solutions. You only pay when someone engages with your ad. Working with a social media marketing agency in India ensures businesses receive expert guidance on building a cohesive online presence and running impactful campaigns. Customizable digital marketing packages make it easier for businesses to choose solutions that align with their goals and budget, ensuring maximum ROI. Social media marketing services provide a cost-effective solution for small businesses to compete with larger brands by targeting niche audiences effectively.

Channels to Use:

Real-time engagement builds trust and loyalty. Through features like live chats, polls, and direct messaging on social platforms, businesses can connect directly with their customers. Our social media marketing services list includes platform management, content creation, ad campaigns, and analytics to help businesses succeed online. A comprehensive social media marketing services list should include campaign planning, audience targeting, analytics, and creative content development tailored for each platform.

Channels to Use:

Digital marketing helps local businesses expand beyond their physical store by leveraging e-commerce platforms. Setting up an online store allows you to cater to customers outside your immediate vicinity.

Channels to Use:

Customer reviews and testimonials influence buying decisions. Encouraging satisfied customers to leave reviews on platforms like Google, Zomato, or TripAdvisor can build trust and credibility.

Channels to Use:

Digital marketing tools provide valuable data about customer behavior and campaign performance. Analytics help businesses understand what works and what doesn’t, enabling them to refine their strategies. Professional social media marketing services include analytics to measure campaign performance and refine strategies for maximum ROI.

Channels to Use:

In a crowded marketplace, digital marketing helps businesses stand out. By offering unique services, using educational content, or providing convenience like online bookings, businesses can outshine competitors.

Channels to Use:

By using a mix of SEO, social media marketing, email campaigns, and retargeting ads, businesses can attract customers and increase conversions. Promotions, festive offers, and loyalty programs can further boost revenue.

Channels to Use:

At Clarigro, we specialize in providing custom or tailored digital marketing solutions based on your unique business objectives. Our team takes the time to assess your industry, target market, and audience to craft strategies that deliver measurable results. Whether it’s optimizing your local visibility, running cost-effective ad campaigns, or building an engaging social media presence, we align our efforts with your specific goals.

Digital marketing is no longer optional for local businesses in India; it’s essential. From increasing visibility and building trust to driving sales and fostering engagement, digital marketing opens endless opportunities for growth. Whether you’re a small café in Goa or a tech startup in Bengaluru, digital marketing provides the tools to reach your audience, build a strong brand, and drive success.

Are you ready to take your local business to the next level with digital marketing? Contact us for a free consultation and let us craft a strategy tailored to your needs!

If you’re a business owner or freelancer, understanding the 1099 form for contractors is crucial for accurate tax reporting. This essential tax document is used to report payments made to independent contractors and freelancers for services rendered. Filing the 1099 form correctly ensures compliance with IRS regulations, avoids penalties, and keeps your finances on track.

In this blog, we’ll break down what a 1099 form is, how to fill it out, and answer common questions like “Is an I-9 form the same as a 1099?” and “How to create a 1099 form in QuickBooks.” We’ll also provide useful insights into managing contractor taxes and even highlight the benefits of outsourcing tax preparation services.

A 1099 form for independent contractors is a tax form issued by businesses to report payments of $600 or more made to contractors or freelancers in a tax year. Unlike traditional employees, contractors don’t receive a W-2 form because they are not subject to payroll tax withholding.

The 1099 form is a critical document for both businesses and contractors, as it helps the IRS track income not reported through payroll. Common types of 1099 forms include:

Filling out a 1099 form can seem intimidating, but breaking it into steps simplifies the process. Here’s a detailed guide:

Before you start, you’ll need:

You can send the form via mail or electronically. For e-filing, consider using software like QuickBooks.

6. When Are 1099s Issued?

The issuance deadlines for 1099 Form for Contractors vary depending on the type of form. For instance, Form 1099-NEC is due by January 31 each year. If January 31 falls on a non-business day, the deadline shifts to the next business day.

Deadlines for Sending 1099 Forms

If you’re responsible for sending 1099 Form for Contractors:

Why Are 1099 Deadlines Early?

Payers are required to send 1099 forms early in the tax season to ensure:

These early deadlines assist the IRS in detecting refund fraud and verifying the accuracy of tax filings.

For more information, explore the various types of 1099 forms below.

If you use QuickBooks for bookkeeping, you can streamline the process of creating and printing 1099 forms. Here’s how:

For detailed instructions, check out the QuickBooks Help section on how to print 1099 forms in QuickBooks Online.

If you notice an error on your 1099 form, it’s important to act quickly. Contact the business that issued the form as soon as possible and request a correction. In many cases, they can resolve the error before submitting the incorrect 1099 to the IRS.

For employers who’ve submitted an incorrect 1099 form, filing a corrected version is essential. Use the same method as the original submission and send an updated copy to the contractor so they can accurately file their taxes.

To avoid these errors and ensure compliance, consider hiring professional tax preparation services like Clarigro. A trusted expert can help manage your filings, minimize mistakes, and maximize deductions.

Looking to save on taxes? Check out our Self-Employed Tax Deduction Calculator for Contractors to uncover potential tax savings.

Simplify your tax process and avoid headaches with professional support from Clarigro.

Is an I-9 Form the Same as a 1099?

No, an I-9 form and a 1099 form are entirely different.

What Is a Form 1099-S?

Form 1099-S is used to report real estate transactions. If your business deals with property sales, this form is necessary to report payments from those transactions.

How to Fill Out a W-8 Form?

A W-8 form is used by non-U.S. individuals or entities to certify their foreign status and claim treaty benefits, avoiding double taxation. For example, if you work with international contractors, they may need to submit a W-8 form instead of a W-9.

Managing contractor payments and taxes can be overwhelming, especially during tax season. By opting for outsourced tax preparation services, you can:

At Clarigro, we offer expert tax preparation services tailored to meet your business needs. Learn more about our accounting and tax return services here.

QuickBooks simplifies the 1099 form for contractors filing process with features like automatic calculations and e-filing. It’s especially helpful for businesses with multiple contractors. Here’s why you should consider it:

If you’re unsure about setting up QuickBooks, our team at Clarigro can guide you.

Clarigro has the best bookkeeping and tax experts and professionals that provide comprehensive module solutions for all the outsourcing 1099 reporting services which include 1099-MISC, 1099-INT, 1099-DIV, 1099-R, 1099-NEC, etc. We will help you every step of the way with all of your 1099 filing requirements.

Clarigro is one of the most top leading outsourcing accounting and bookkeeping companies that provide 1099 e-file services to small business owners.

Outsourced Accounting Solutions Year-End Checklist: Prepare for a smooth 1099 form for contractors reporting season with our comprehensive year-end checklist. This checklist helps to simplify year-end tasks and reduce the risk of errors by covering key steps like vendor record updates and payment categorization. Identify who needs a 1099, learn how to clean up your books and review payments and transactions. Contact Clarigro for further information.

Refer to our checklist for more information: 1099 Preparation Checklist 2025_Clarigro

In today’s digital-first world, real estate businesses must adapt to online platforms to connect with potential buyers. Digital marketing services for real estate offer various tools and strategies to help you reach the right audience, generate leads, and convert them into loyal customers. This blog explains how digital marketing solutions for real estate works, simplifying terms like SEO, lead nurturing and CRM so that even those unfamiliar with digital marketing solutions jargon can make informed decisions.

Digital marketing services for real estate is a structured approach to attract potential buyers, engage them meaningfully, and convert them into customers. Below is a detailed explanation of each step in the process:

Before you start digital marketing solutions your properties, it’s essential to define your target audience. This step helps you tailor your strategies and communication effectively.

Why is it important? Not every property is suitable for every buyer. For example, a luxury apartment might appeal to high-income professionals, whereas a compact home might interest first-time buyers or small families. By understanding who your buyers are, you avoid wasting resources marketing to the wrong audience.

How to do it:

Once you know your audience, you can create personalized campaigns that resonate with their needs and motivations.

Your website is often the first impression potential buyers have of your business. A well-designed, functional website can make or break your digital solutions efforts.

Key Features of a Great Website:

Your website should act as your online office open 24/7, accessible, and informative.

SEO is the backbone of organic digital marketing solutions, helping your website rank higher on search engines like Google when people search for relevant keywords.

What is SEO?SEO involves optimizing your website’s content and structure so that search engines consider it valuable for users. For instance, if you optimize for the keyword “affordable homes in Dallas,” your site can appear in the top results when someone searches for it.

Why is SEO a Long-Term Investment?

How to Get Started:

Google Ads offers a quicker way for digital marketing solutions to reach potential buyers by displaying your ads at the top of search engine results.

What Are Google Ads?These are paid advertisements triggered by specific keywords. For example, if someone searches for “buy luxury apartments in Miami,” your ad will appear above the organic search results.

How Are Google Ads Different from SEO?

Benefits of Google Ads for Real Estate:

Social media platforms like Instagram, Facebook, and LinkedIn are ideal for real estate businesses because they are visual and interactive.

How to Use Social Media Effectively:

Social media isn’t just about selling—it’s about building connections and staying top of mind.

Content marketing involves creating valuable materials that educate and engage your audience.

Examples of Real Estate Content:

Why It Matters:Content builds trust and positions your business as an expert in real estate. When potential buyers see you as knowledgeable, they’re more likely to choose you over competitors.

Email marketing is a simple and cost-effective way to nurture leads and keep them engaged.

How to Use Email Effectively:

Why It Works:Email marketing keeps your business top-of-mind and encourages potential buyers to take the next step.

A CRM (Customer Relationship Management) system helps you organize and track your leads efficiently.

How CRM Tools Help Real Estate Businesses:

Why CRM Is Essential:In real estate digital marketing services, multiple leads come in daily. A CRM ensures no opportunity is missed, and it helps you manage your pipeline more effectively.

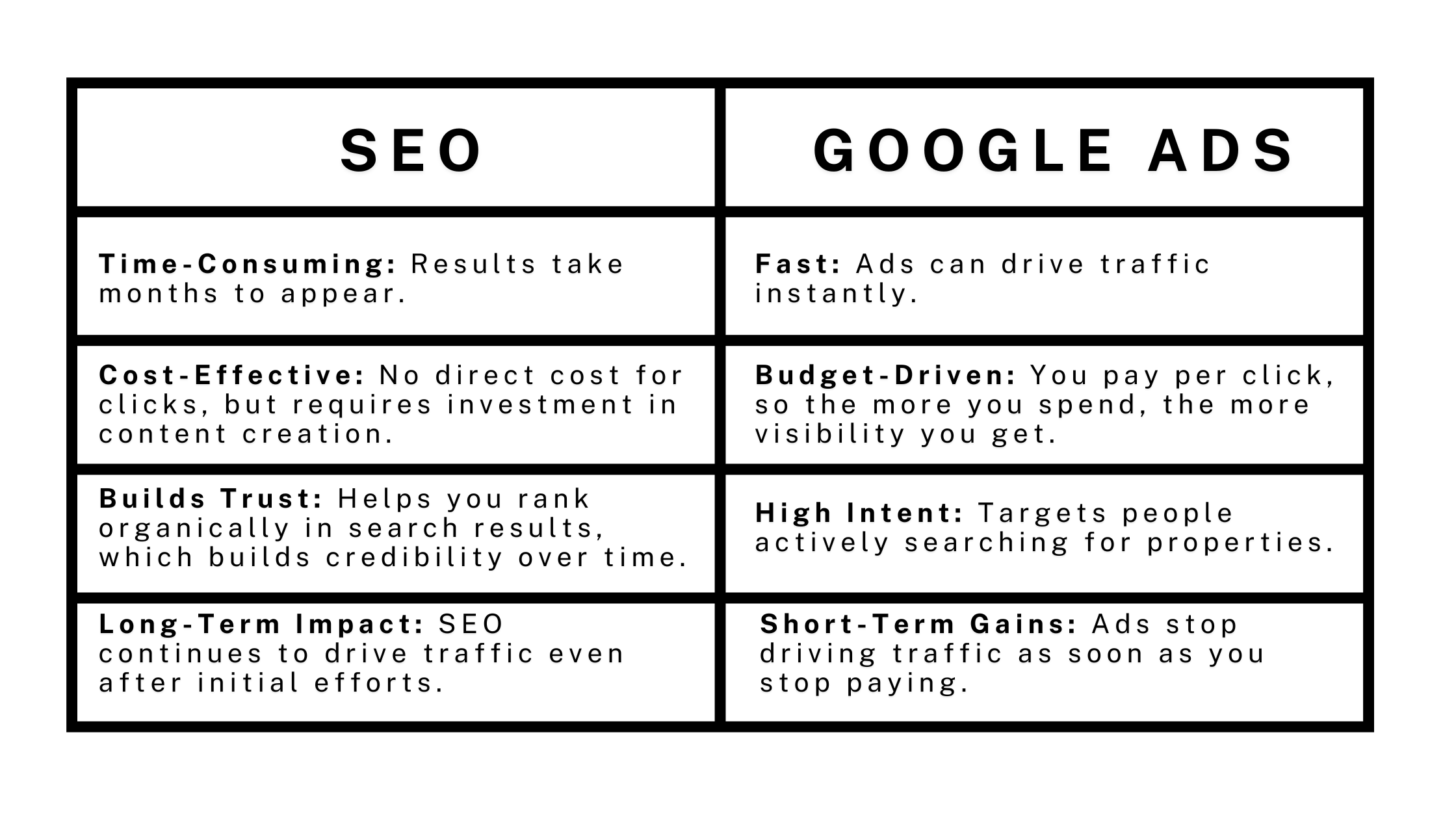

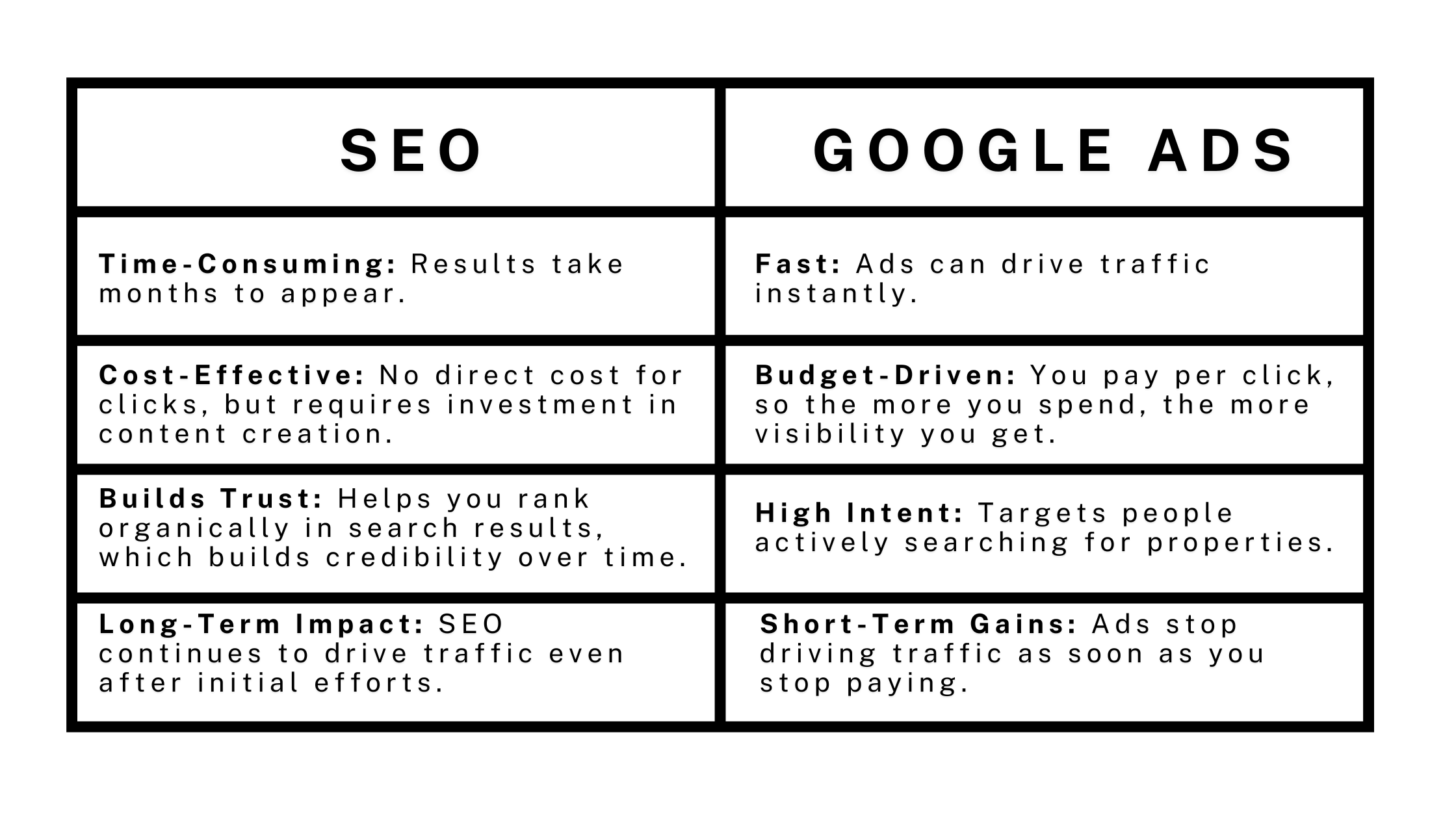

SEO vs. Google Ads: Understanding the Difference

While both SEO and Google Ads are essential parts of digital marketing solutions, they serve different purposes:

Pro Tip: Use both strategies together—SEO for long-term growth and Google Ads for immediate results.

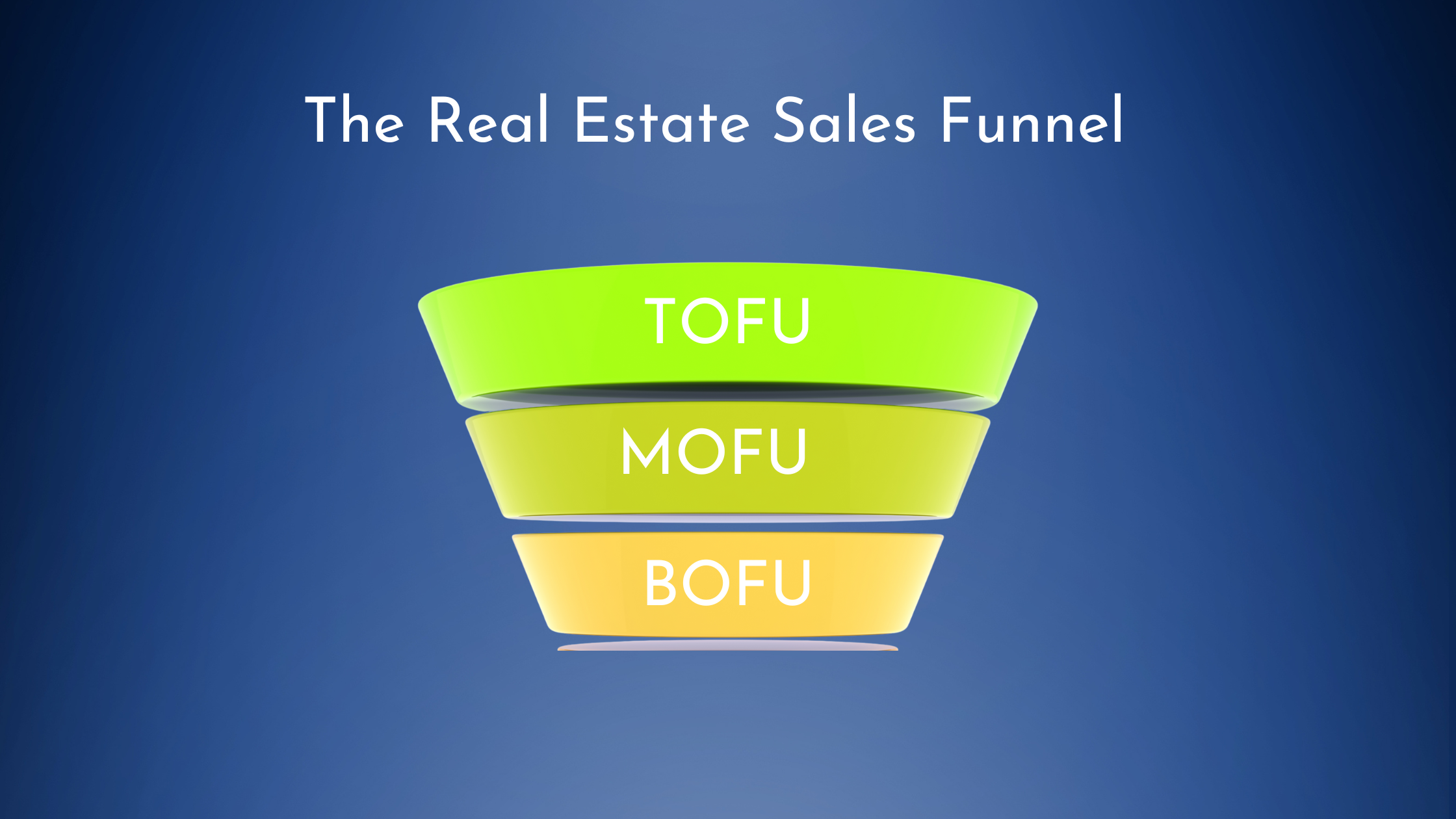

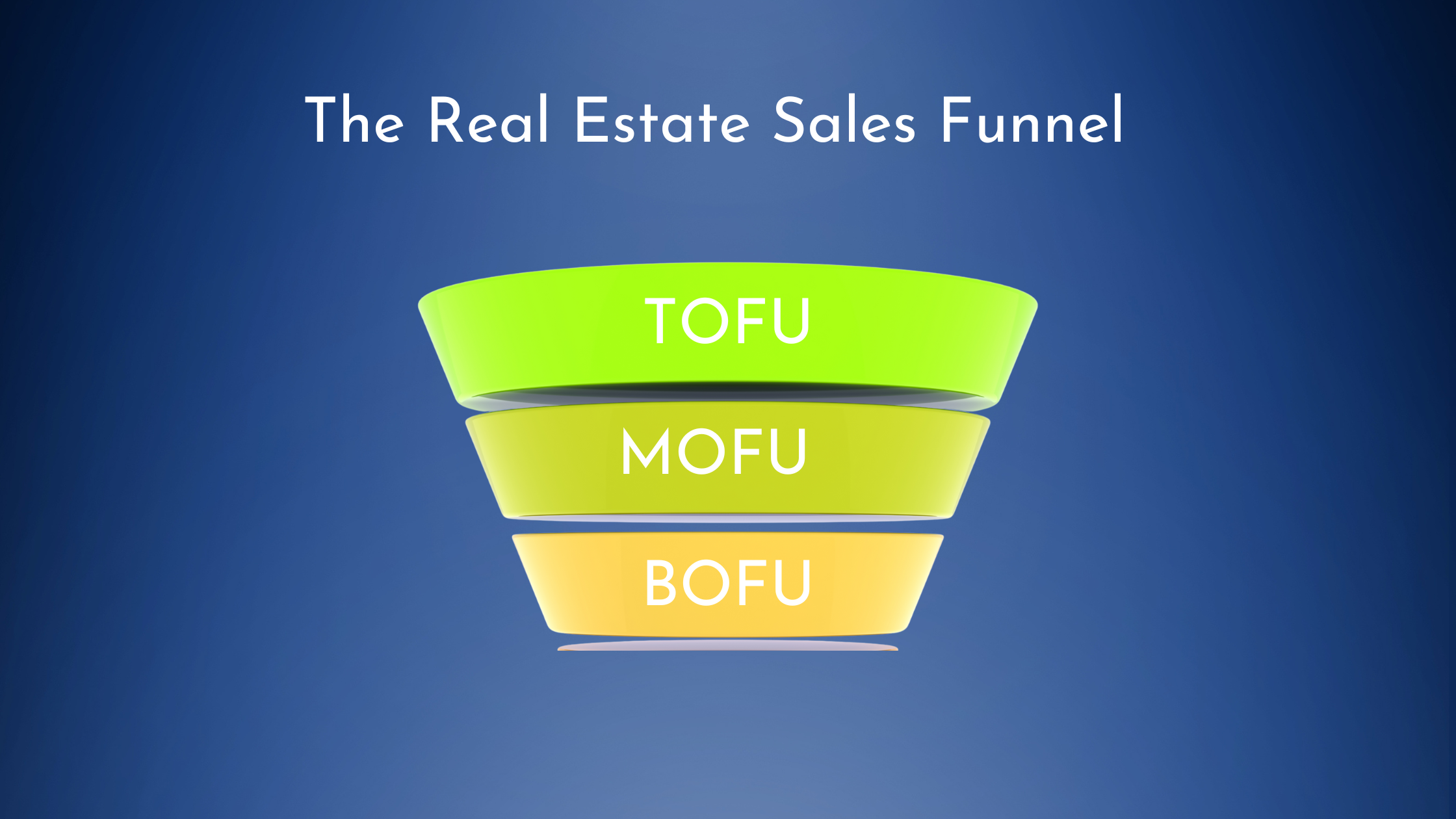

The real estate industry revolves around building trust, nurturing relationships, and guiding potential buyers through a structured process that ultimately leads to a sale. To understand the significance of the lead journey, lead nurturing, and sales funnel in real estate, let’s start with the basics.

A sales process is a series of steps that guide potential customers (leads) from the moment they show interest in your properties to the point where they purchase or sign a contract. It ensures consistency, tracks progress, and improves the likelihood of closing deals.

The lead journey refers to the path a potential buyer takes from discovering your real estate business to making a purchase. This journey is divided into three main stages:

1. Awareness Stage: Getting Noticed

At this stage, the potential buyer is learning about your business for the first time through advertisements, social media, or search engines.

2. Consideration Stage: Providing Information

Here, the lead is evaluating options and comparing your properties to others in the market.

3. Decision Stage: Closing the Sale

This is the final stage where the lead is ready to make a purchase.

Lead status helps categorize where each potential buyer is in the sales process. This ensures your team knows how to handle them effectively.

Not all leads are the same. Here’s a breakdown of lead types:

Lead nurturing is the process of building relationships with potential buyers to guide them through their lead journey. It ensures that even if a lead isn’t ready to buy immediately, they stay engaged and are more likely to choose your business when they are.

The Process of Lead Nurturing:

A sales funnel is a visual representation of the stages a lead goes through before becoming a customer. It narrows as leads move through the process because not all leads convert into sales.

A sales workflow outlines the actions your sales team takes at each stage of the sales process. It ensures consistency, efficiency, and better conversion rates.

Example of a Real Estate Sales Workflow:

The lead journey ensures you don’t lose potential buyers by engaging them at every stage. Real estate purchases are high-involvement decisions, and buyers often need time and information before committing.

While digital marketing services for real estate generate leads, the sales team converts them into customers. Here’s how:

Digital Marketing Solutions can transform your business by helping you attract the right audience, nurture leads, and close sales efficiently. By understanding the strengths of strategies like SEO, Google Ads, Social Media Marketing and CRM tools, you can create a balanced approach that delivers both short-term results and long-term growth.

Ready to grow your real estate business? Contact us for a free consultation today and start attracting customers for your properties!

In today’s competitive business landscape, securing investment or conveying your business idea effectively hinges on a well-designed pitch deck. A pitch deck design is more than just slides; it’s a strategic tool that communicates your vision, potential, and credibility to investors or stakeholders. With expert pitch deck consulting services, businesses can create impactful presentations that stand out, increasing the likelihood of achieving their goals.

At Clarigro, we specialize in offering comprehensive solutions, including management consulting and investor pitch deck services, tailored to meet the needs of growing enterprises.

1. Creating a Strong First Impression

Your pitch deck is often the first interaction potential investors or partners have with your business. A professional pitch deck design captures attention, communicates professionalism, and reflects your brand identity.

2. Highlighting Key Insights

Investors are busy and need to quickly understand the potential of your business. A pitch deck company ensures that key insights—such as your market strategy, financial projections, and unique value proposition—are highlighted effectively.

3. Customized Visual Appeal

The visual design of your pitch deck can make or break your presentation. A professional pitch deck design agency ensures that your deck uses the right balance of visuals, text, and branding, creating an aesthetically pleasing and persuasive presentation.

1. Understanding Investor Expectations

Professional consultants understand what investors look for in a pitch deck. They tailor the content and design to align with these expectations, giving your presentation a competitive edge.

2. Crafting a Cohesive Narrative

Your pitch deck should tell a compelling story about your business journey, goals, and potential. Consulting services ensure a seamless flow that captures attention and maintains engagement.

3. Integrating Data-Driven Insights

An experienced pitch deck design agency incorporates data-backed insights, making your pitch more credible. Whether it’s market analysis or financial forecasts, data is presented in a clear and impactful way.

1. Expertise in Design and Strategy

A professional pitch deck company has the expertise to merge design aesthetics with strategic insights. This ensures your pitch deck isn’t just visually appealing but also aligned with your business goals.

2. Tailored Solutions for Diverse Industries

Different industries have unique needs. A seasoned pitch deck design agency can tailor your presentation to resonate with industry-specific investors or stakeholders.

3. Time and Resource Efficiency

Creating a pitch deck in-house can drain time and resources. Outsourcing to a pitch deck company allows your team to focus on core business activities while experts handle the presentation.

1. Clear Value Proposition

The deck should clearly articulate why your business idea matters and what sets you apart from competitors.

2. Engaging Visuals

High-quality images, charts, and graphics make your presentation engaging and easy to understand.

3. Concise Content

Avoid overwhelming your audience with too much information. Focus on key points that drive your message home.

4. Professional Branding

Consistent branding in your pitch deck reflects your business’s professionalism and attention to detail.

At Clarigro, we combine expertise in management consulting and pitch deck creation to deliver solutions that drive results. Our team excels in crafting decks that resonate with investors and align with your business strategy.

Whether you need to impress investors, secure funding, or communicate your vision, our pitch deck consulting services ensure your presentation stands out. Explore our management consulting services to see how we can help your business thrive.

A well-crafted pitch deck can be a game-changer for your business. With professional pitch deck design services, you gain access to expertise that enhances your presentation, making it both visually captivating and strategically effective.

Partner with Clarigro to unlock your business’s growth potential. Our pitch deck consulting services are designed to help you succeed in every presentation.

Take the next step toward success—connect with us today to transform your ideas into impactful presentations!

In today’s digital age, small businesses face numerous challenges in reaching new customers and staying competitive in their industries. Digital marketing has emerged as a powerful solution to these challenges, providing cost-effective strategies to help businesses increase their visibility, drive traffic, and build a loyal customer base. In this blog, we will explore how digital marketing can help small businesses grow and succeed, highlighting key tactics and resources that can make a difference. digital marketing for small business offers a cost-effective way to reach targeted audiences and drive sustainable growth.

Small businesses typically have limited budgets and resources. Traditional marketing methods like TV ads, print media, and billboards can be costly and less targeted. In contrast, digital marketing for small business offers affordable and scalable solutions that allow businesses to reach their target audience effectively, track results, and refine strategies as they go. From search engine optimization (SEO) to social media marketing, digital marketing encompasses a wide range of techniques that can significantly enhance your business’s online presence and lead to growth.

1.Search Engine Optimization (SEO)

SEO is a vital aspect of digital marketing that helps businesses appear in search engine results when potential customers search for relevant keywords. For small businesses, appearing on the first page of search results can lead to increased website traffic and higher conversion rates. This is where digital marketing can make a significant impact for small businesses, ensuring you rank for relevant keywords and attract quality leads.

SEO agencies specialize in optimizing websites to improve their rankings on Google and other search engines. This includes on-page SEO (optimizing content and meta tags), off-page SEO (building backlinks), and technical SEO (improving website speed and structure).

Small businesses can also benefit from local SEO strategies, which ensure they appear in local search results when customers search for services in their area. Tools like SEMrush, Ahrefs, and Ubersuggest provide insights into keyword rankings and help businesses optimize their websites for better performance.

Learn more about our Growth Marketing services here

2. Social Media Marketing

Social media platforms like Facebook, Instagram, Twitter, and LinkedIn offer small businesses an affordable way to connect with customers, promote products, and build brand loyalty. However, managing social media marketing can be time-consuming for small business owners. That’s where partnering with a social media marketing company for small business comes in.

Social media marketing enables businesses to target specific audiences based on demographics, interests, and behaviors, ensuring that content reaches the right people. By using effective digital marketing strategies, small businesses can boost their social media presence and engage directly with their audience. Regularly posting engaging content, running targeted ads, and interacting with followers can boost brand awareness and sales.

Through social media, small businesses can humanize their brands, showcase customer testimonials, and share valuable content. This builds trust and credibility, which are crucial for customer retention.

Explore our Digital Marketing Packages

3. Pay-Per-Click Advertising (PPC)

PPC campaigns, such as Google Ads or Facebook Ads, allow small businesses to place ads on search engines and social media platforms, paying only when someone clicks on their ad. With digital marketing for small business strategies, PPC can yield faster results by placing ads in front of customers actively searching for your services. This results-driven approach can help businesses gain immediate visibility in a competitive market.

One of the key benefits of PPC is the ability to target customers based on keywords, location, and interests, ensuring that your ads are shown to the most relevant audience. As your business grows, you can adjust your budget and refine your targeting to maximize your ROI.

4. Content Marketing

Content marketing is a long-term approach that emphasizes creating valuable and relevant content for your audience. This can include blog posts, infographics, videos, or podcasts. By providing valuable content, small businesses can attract potential customers, establish brand authority, and boost organic traffic.

For digital marketing services for small business, content marketing can play a vital role in driving leads. By addressing customer pain points and answering their questions, businesses can position themselves as thought leaders in their industries. Content marketing also works well in tandem with SEO, as well-optimized content ranks higher in search engine results.

For example, small businesses can create blogs about industry trends, how-to guides, and product reviews. This content can then be shared on social media platforms, newsletters, or other digital channels to expand reach.

Visit Clarigro for more details on Digital Marketing Services for Small Business

5. Email Marketing

Email marketing is an effective way to stay connected with existing customers and nurture new leads. Small businesses can use email campaigns to promote products, announce discounts, share content, and remind customers of their brand.

By segmenting your email list, you can send personalized messages based on customer interests and behavior, making the communication more relevant. Email marketing automation tools like Mailchimp and Constant Contact can help streamline the process and improve conversion rates.

6. Website and Conversion Optimization

A website is typically the first interaction between a business and potential customers. Therefore, it’s essential for small businesses to have a well-designed, user-friendly website that encourages visitors to take action, whether that’s making a purchase, signing up for a newsletter, or requesting a quote.

Digital marketing agencies specialize in website optimization, ensuring that the site is mobile-friendly, fast, and easy to navigate. They also focus on conversion rate optimization (CRO), which involves making changes to the website to increase the likelihood of visitors completing a desired action.

Having clear calls-to-action (CTAs), high-quality images, and persuasive copy can make a significant impact on conversion rates.

Digital marketing for small business helps increase brand awareness, attract qualified leads, and build customer loyalty. By leveraging various digital marketing channels, small businesses can benefit from the following:

Digital marketing has become a necessity for small businesses looking to thrive in a competitive online world. When implemented correctly, digital marketing for small business can fuel growth, improve customer retention, and drive long-term success. By utilizing strategies such as SEO, social media marketing, PPC, content marketing, and email marketing, small businesses can increase their visibility, attract new customers, and build lasting relationships with their audience.

Whether you are looking to optimize your website, create engaging content, or run targeted social media campaigns, digital marketing for small business is the key to unlocking growth and success. Partnering with experienced digital marketing agencies can further enhance your business’s online presence and help you achieve your growth objectives.

If you’re ready to take your business to the next level, visit Clarigro for more details and explore our growth marketing services.

Do you have any queries? Feel free to get in touch with our Expert today.

Start your journey with us